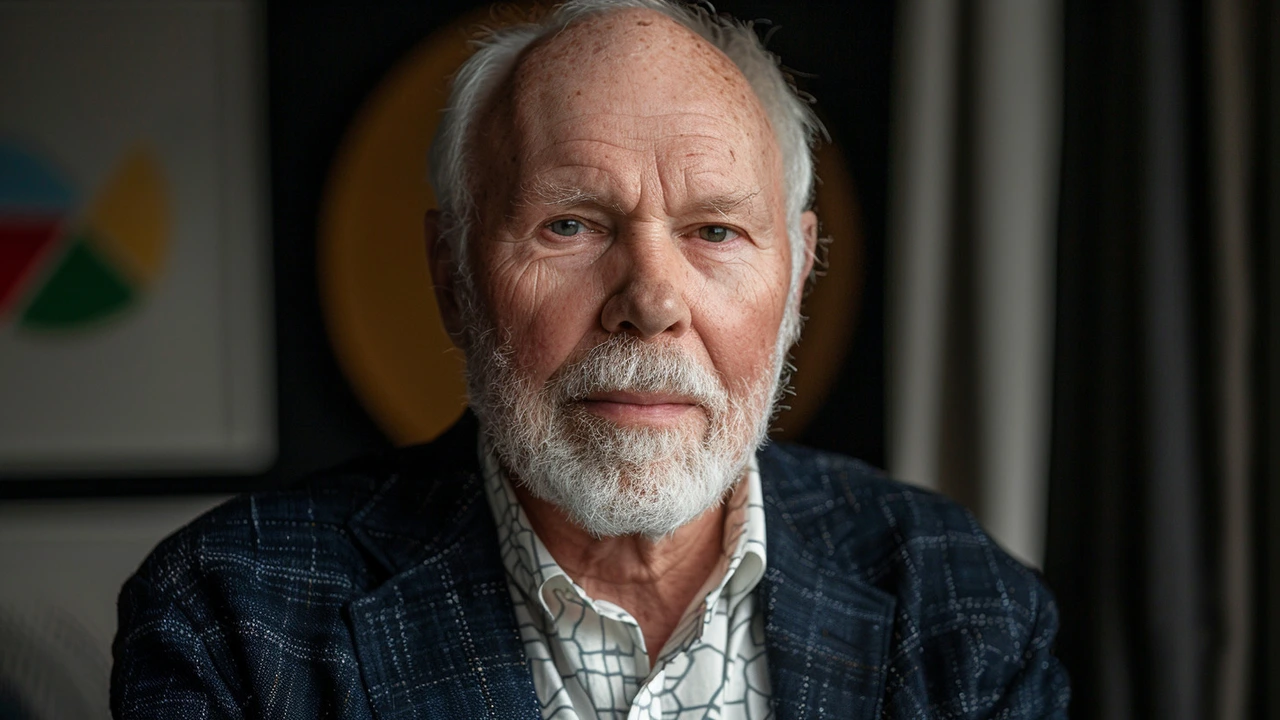

Jim Simons: A Legacy of Intellectual Brilliance and Generosity

The world recently said farewell to one of its most brilliant mathematical minds and a beacon of philanthropy, James 'Jim' Simons, who passed away at the age of 86. As news of his passing filters through the academic and financial communities, many remember his profound impact on both fields. A key figure in quantitative investing, Simons was also a relentless supporter of scientific research, leading efforts that expanded our understanding of everything from disease to the cosmos.

Early Contributions and Academic Prowess

Jim Simons’ journey began in the hallowed halls of academia. After securing a PhD in mathematics, he embarked on a career that saw him ascend to the chairmanship of the Mathematics Department at Stony Brook University. His tenure at Stony Brook was marked by a fervent push towards elevating the standards and reach of the department, making significant contributions to both the faculty and the curriculum.

Simons’ prowess in mathematics was not just confined to academia. His work in geometry and topology earned him international acclaim, and his name became synonymous with groundbreaking theoretical insights. These were not just esoteric pursuits; Jim Simons applied these complex theories to practical scenarios, particularly in financial markets.

A Revolutionary Approach to Investing

The leap from academics to finance was marked by the founding of Renaissance Technologies in 1982. This hedge fund, under Simons’ stewardship, became a juggernaut in the world of quantitative investing. By employing sophisticated mathematical models to predict market trends, Simons' firm consistently outperformed its peers, a testament to his belief in the power of algorithms and data over traditional investment methods.

Simons’ approach to investing was revolutionary and set the stage for what is now a burgeoning field of quantitative finance. Through his work, Simons not only redefined personal success but also reshaped the industry, propelling it toward a more analytical and precise future.

Philanthropic Ventures and Scientific Advancement

One of the most impactful aspects of Simons’ legacy is his philanthropy. Alongside his wife, he established the Simons Foundation, a pivotal entity in the realm of scientific research. The foundation has facilitated critical advances in a variety of domains, from understanding autism to exploring the farthest reaches of the universe. Their donations have supported research in cellular biology, computational science, and more, significantly advancing human knowledge and improving lives.

His philanthropic efforts were not limited to research. Simons was a passionate advocate for science education and outreach, evidenced by his long-standing relationship with the New York Academy of Sciences. As a board member and benefactor, he played a crucial role in shaping the academy's initiatives, aimed at making science accessible and exciting to the public.

Final Thoughts and Continued Impact

The passing of Jim Simons marks the end of an era but also the continuation of a legacy. Through his contributions to mathematics, finance, and philanthropy, Simons has left an indelible mark on the world. His life's work continues to inspire new generations of thinkers and doers who stand on the shoulders of this gentle giant.

As tributes pour in and his family, friends, and colleagues reflect on his monumental legacy, it is clear that Jim Simons was much more than a mathematician or an investor; he was a visionary who believed in the power of knowledge to transform society. The ripples of his actions will be felt for decades, if not centuries, to come, in the corridors of universities, the boards of philanthropic organizations, and anywhere where curiosity meets the rigor of science.

Bruce Moncrieff

May 11, 2024 AT 19:58 PMJim Simons was a true trailblazer in the world of math and finance his journey from chalkboards to billion‑dollar algorithms is downright inspiring. He proved that pure theory can power real‑world success and that curiosity never grows old. The way he turned topology into a trading engine feels like something out of a sci‑fi novel. Respect to the legend who kept pushing boundaries.

Dee Boyd

May 12, 2024 AT 23:45 PMFrom a scholarly perspective, Simons' contributions epitomize the translational potential of abstract algebraic topology into quantitative market models, thereby effectuating a paradigm shift in asset allocation strategies. His iterative deployment of stochastic differential equations and high‑dimensional statistical inference frameworks rendered the conventional risk‑return calculus obsolete. Such methodological rigor underscores the indispensability of interdisciplinary synthesis in contemporary finance.

Carol Wild

May 14, 2024 AT 03:32 AMHonestly, reading this tribute feels like a subtle reminder that the elite few control the levers of both knowledge and capital, and they do it behind an almost mythic veil that most of us can barely comprehend. Jim Simons, a name echoed in hushed tones across Ivy League corridors, certainly pushed the envelope of what a mathematician can achieve, but let’s not pretend his philanthropic empire isn’t also a vehicle for steering scientific agendas toward his own concealed interests. The Simons Foundation, while funding groundbreaking research in autism and cosmology, simultaneously creates a dependency loop where researchers chase grant dollars instead of pursuing truly disruptive ideas that might challenge the status quo. One could argue that this model of “benevolent” patronage subtly reinforces the existing power structures, ensuring that only projects aligning with his or his foundation’s worldview receive the necessary resources. Moreover, the sheer scale of his quantitative hedge fund, Renaissance Technologies, functions as a testament to how algorithmic supremacy can eclipse traditional market dynamics, effectively allowing a select group to dictate trends that the rest of us merely observe. This concentration of computational prowess and financial influence, shrouded in secrecy, fuels speculation about the true extent of market manipulation that remains unregulated and largely invisible to the public. It’s plausible that the same data‑driven techniques that yielded astronomical returns also provided unprecedented insight into global economic patterns, granting Simons and his inner circle a covert lever of influence over macro‑economic policy decisions. In the grand tapestry of scientific advancement, the narrative can’t ignore how philanthropy, when intertwined with immense personal wealth, may serve as a conduit for perpetuating a subtle form of intellectual imperialism where the benefactor curates the direction of research based on his own philosophical biases, however well‑intentioned they may appear on the surface. The legacy of Jim Simons, therefore, is not merely a story of brilliance and generosity, but also a complex, layered discussion about the ethical dimensions of power, privilege, and the hidden mechanisms by which elite individuals shape the very fabric of both scientific discovery and financial markets, often without the transparent scrutiny that a truly democratic society demands. In short, while we celebrate his accomplishments, we must also stay vigilant about the long‑term implications of such concentrated authority over the engines of knowledge and capital.

Rahul Sharma

May 15, 2024 AT 07:18 AMSimons' transition from academia to algorithmic trading is a textbook case study; his deep understanding of differential geometry, combined with an uncanny ability to synthesize massive datasets, enabled the creation of predictive models that consistently outperformed benchmarks. By integrating concepts from stochastic calculus, machine learning, and high‑frequency data streams, he effectively turned abstract mathematical constructs into actionable trading signals. This interdisciplinary approach not only revolutionized hedge fund strategies but also set a new benchmark for quantitative research methodologies across the financial sector.

Emily Kadanec

May 16, 2024 AT 11:05 AMHonestly its clear that Simons knew what he was doing even if some peeps think its just luck. He wasnt just some random guy with a fancy degree, he defintely knew how to use them maths to win big in the market. Its not rocket science to see that the foundation does a lot of good, but dont overhype it.

william wijaya

May 17, 2024 AT 14:52 PMReading about Simons always feels like watching a dramatic saga where equations become the heroes and the markets the battlefield. His use of advanced statistical models turned the chaotic noise of daily trading into something almost poetic, a symphony of data points playing in harmony. The philanthropic side adds another layer, showing that the same analytical mind can also nurture curiosity in fields far beyond finance.

Lemuel Belleza

May 18, 2024 AT 18:38 PMInteresting read, though it sounds like typical glorification of a billionaire.

faye ambit

May 19, 2024 AT 22:25 PMSimons' legacy prompts reflection on how intellectual rigor can serve broader humanity when coupled with genuine generosity. The intertwining of abstract thought and tangible impact reminds us that the pursuit of knowledge need not be isolated from compassion.

Subhash Choudhary

May 21, 2024 AT 02:12 AMAgreed, his work shows a beautiful blend of science and service without any pretentious airs.

Ethan Smith

May 22, 2024 AT 05:58 AMSimons was a genius.

Evelyn Monroig

May 23, 2024 AT 09:45 AMWhile most hail Simons as a benevolent savior of science, we must consider the hidden agenda that often accompanies massive private funding; such philanthropy can subtly steer research priorities, creating echo chambers that align with the benefactor's worldview and consequently marginalize dissenting or unconventional inquiries that could challenge entrenched narratives.